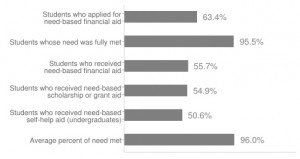

UR financial aid data for the year 2011-2012 as reported by U.S. News and World Report reflects a microcosm of national need, for which U.S. President Barack Obama has launched a targeted reform campaign. Courtesy of colleges.usnews.rankingsandreviews.com

Bowing to increasing pressure from financially burdened students and recent graduates, U.S. President Barack Obama announced two new measures to help students struggling with loan debt on Tuesday, Oct. 25.

The U.S. Department of Education will start offering both tenets of Obama’s plan next January, instead of in 2014, as originally scheduled by Congress in 2010. This decision was made due to what the Obama administration has called an overwhelming amount of pressure to address students’ needs and the recent media attention to the magnitude of the student loan debt garnered by Occupy Wall Street and related movements worldwide.

Both programs could have widespread implications for UR students, especially in terms of post-graduation plans. According to UR Dean of Admissions and Financial Aid Jonathan Burdick, such effects will likely not impact UR’s admissions process. He sees that the legislation presents an opportunity to extend financial knowledge to students and parents, and said that “loans haven’t been one of the reasons that students come or don’t come,” as UR is relatively “moderate in basic loan expectations.”

“It should help students to feel a little more flexible about their financial situation and possibly take jobs that appeal to them because these jobs now have a relatively lower financial impact,” Burdick said.

The first part of Obama’s plan is an enhancement of the existing “Pay as You Earn” option, which will let graduates pay 10 percent of their discretionary income on loans for 20 years, after which the rest of their federal student loan debt would be forgiven.

Currently, borrowers must pay 15 percent of discretionary income for 25 years before debt can be forgiven.

The monthly payments will be 15 percent of any dollars made above the poverty line — $16,335 in 2011. This plan will go into effect in January 2012.

The second part of Obama’s plan will encourage students who have both Federal Family Education Loans and Direct Loans to consolidate them into direct loans. As an incentive, the White House will offer a 0.5 percent interest rate break for all students who consolidate loans from January through June 2012.

Burdick said that many families get into financial trouble with private loans, which often have higher interest rates, and that he does not encourage them in financial counseling at UR. Obama’s legislation would encourage more federal loans, which students can pay back slower — a “good deal,” according to Burdick.

Students who consolidate loans into direct loans will also be eligible for the Public Service Loan Forgiveness component of Obama’s Plan, which will forgive debt after 10 years of eligible employment. Three cases of jobs will qualify: nonprofit, tax-exempt 501 (c)(3) organizations; government jobs; and full-time AmeriCorps or Peace Corps positions.

Despite this lure, Career Center Director Burton Nadler said he believes that UR students have historically been focused on such service-related careers, and that the incentivized legislation might not have a large impact on the future plans of UR students.

“In reality, I’m not sure an incentive program, no matter how well-intended and well-conceived, even with very desirable outcomes, will influence those who understand the values, interests, personality traits and skills-influenced dynamics of job search,” he said.

Nadler stressed that qualifications are more important than incentives and that the potential of students to score interviews depends on “factors beyond financial motivations.” Such factors include past employment and internship experience, “project focused achievements” and an academic courseload that reflects a desired career path, Nadler said.

“It’s about qualifications for a job, not just interest in loan forgiveness,” he said.

Data from UR’s graduating class of 2011 indicates that jobs in public service are attractive. Of the 181 students that indicated they had accepted a full-time job or internship offer or were considering an offer at the time of commencement, 27 had accepted a Peace Corps, AmeriCorps, Teach for America or related service activity — about 15 percent. Four students indicated that they took a position in government.

Burdick says he sees a crucial barrier in the lack of knowledge some people have about these financial issues. He estimated that 56 percent of students and families are “savvy about financial planning,” but 40 percent have never encountered these “challenging questions” before. In an effort to close some of this educational gap, Burdick plans to hire a personal income manager to counsel parents starting with the incoming class of 2016.

He also plans to unveil an online “debt management program” — a tool for understanding college costs and other useful, personalized financial information like improving credit score. Burdick said he plans to discuss both the tool and student financial aid issues at a luncheon on Nov. 16 entitled “Financial Wellness.”

This unique online tool, which was designed by a recent UR graduate, will take students about an hour to complete. Burdick is still unsure how to launch it to gain maximum publicity but does not doubt its importance.

“I know students would find this information really valuable,” he said. “Education is the most important thing you can do.”

Buletti is a member of the class of 2013.